Guardian Trust Capital places great importance on global investing due to the risks in Brazil and the diversification opportunities in other markets. This approach allows investors to benefit from economic growth in various countries and sectors, reducing dependence on a single market.

Guardian Trust Capital's investment strategy is based on three main principles: the market cycle, technical analysis, and fundamental analysis. Let's evaluate them separately:

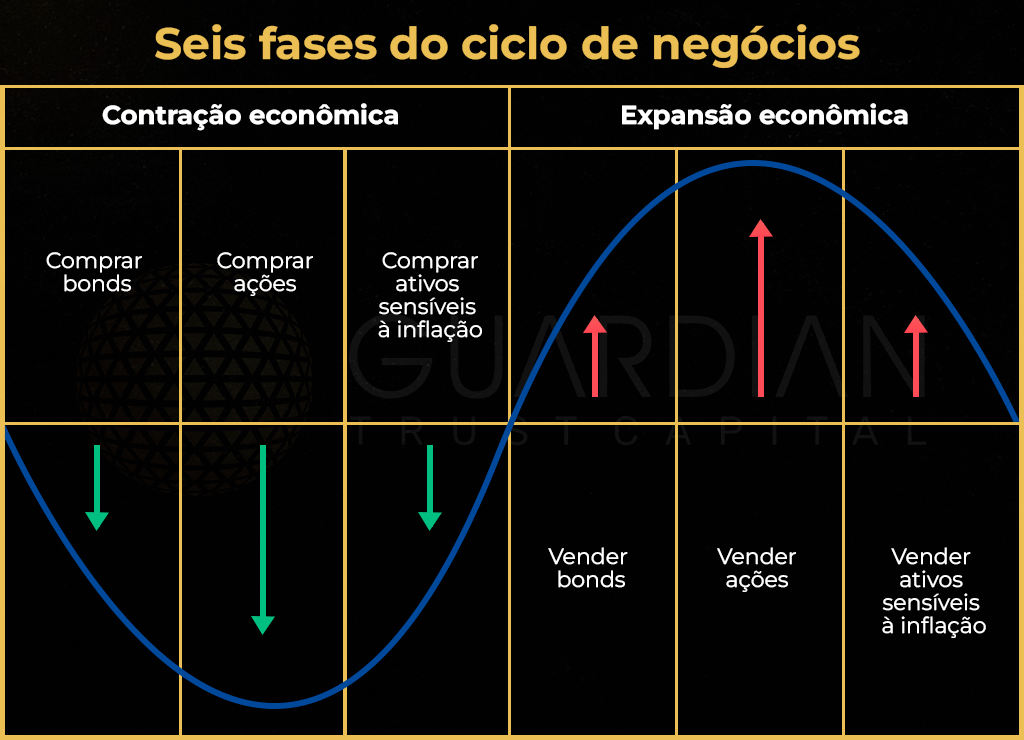

- Market Cycle: just as it's difficult to plant in winter because nothing grows, the same principle applies to markets. Each asset class (stocks, commodities, bonds, precious metals, and cryptocurrencies) behaves in a specific way during the economic cycle. During economic expansion, risk assets tend to rise due to increased demand. Conversely, during economic contraction, demand for defensive assets increases.

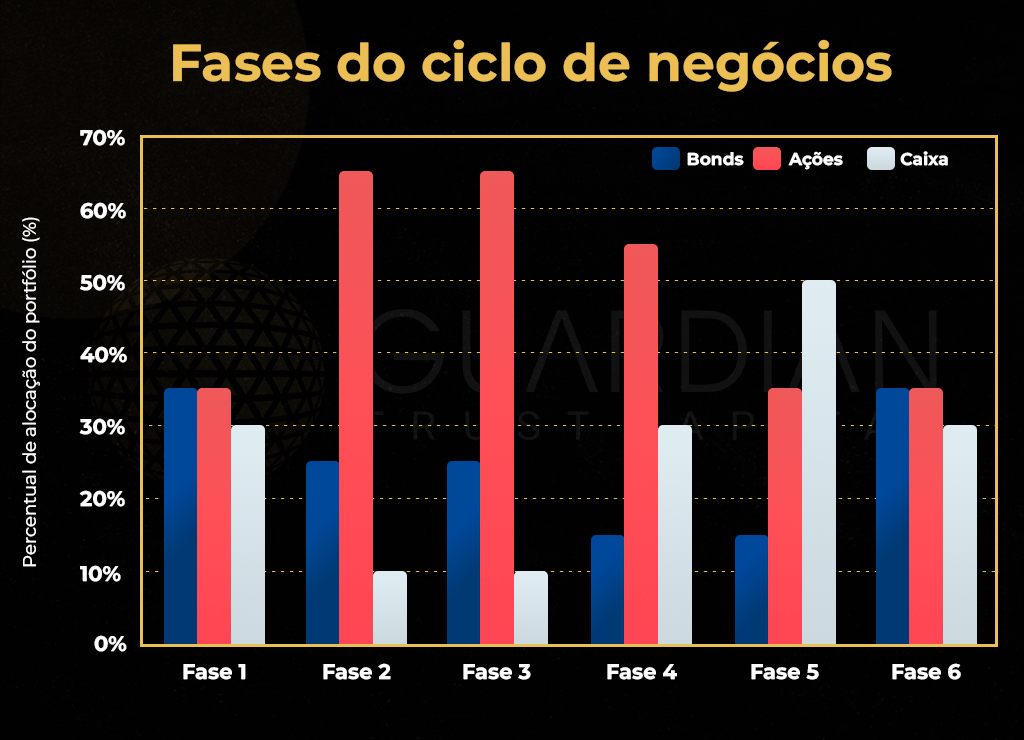

- Technical analysis: in technical analysis, we try to figure out which phase of the economic cycle we are in. To do this, we use special indicators that have been developed using data going back to 1955. When most of these indicators show a "buy" signal, it means the asset class is likely to do well. On the other hand, when most indicators show a "sell" signal, it means the asset class is likely to underperform. These indicators have been tested in various economic and geopolitical situations, including wars, financial crises, and periods of inflation and deflation. Based on this analysis, we can determine the best allocation of assets for each stage of the economic cycle.

- Fundamental analysis: fundamental analysis is used to assess the true value of assets over the long term. The team at Guardian Trust Capital conducts a thorough examination of the financial fundamentals of companies, including their revenues, profits, balance sheets, and growth prospects. This analysis helps to identify sound investments that can yield consistent returns over time. While fundamental analysis is typically used in the stock market, it can also be adapted for the ETF market. In addition to analyzing individual assets, we consider the sector and the overall economy in which the ETF operates. For instance, if the ETF focuses on technology, we evaluate the trends and prospects of the technology sector as a whole.